This Chapter discusses exogenous factors (those outside of ASIC's control) that will impact on ASIC's ability both to respond to the recommendations made in this report, and on its ongoing and future ability to fulfil its mandate efficiently and effectively.

The Panel sees three high level constraints:

- Legislative and regulatory complexity: the increasing complexity of the regulatory regime that ASIC is expected to administer, and in particular the application of the Corporations Act.

- Perceived funding constraints: funding instability and inflexibility, together with perceived underfunding (although it is not clear that this is a real constraint).

- Cooperation with other regulators: the potential limitations imposed through insufficient coordination and forward looking collaboration with peer agencies.

In previous chapters, the Panel made a series of recommendations that are specific to ASIC. It is not within the Terms of Reference of the Review to make recommendations where these would have wider ranging implications (beyond ASIC), and as such this Chapter contains a series of observations. The Panel considers that the corresponding actions identified below provide the Minister with further considerations to incorporate as part of an evolving future program of economic and policy reform.

5.1. Legislative and regulatory complexity

Over time ASIC's mandate has increased with the enactment of new legislation and amendments to existing acts. Today, ASIC is responsible for administering eleven pieces of legislation, and the relevant regulations made under them. These include:174

- Australian Securities and Investments Commission Act 2001;

- Corporations Act 2001;

- Business Names Registration Act 2011;

- Business Names Registration (Transitional and Consequential Provisions) Act 2011;

- Insurance Contracts Act 1984;

- Superannuation (Resolution of Complaints) Act 1993;

- Superannuation Industry (Supervision) Act 1993;

- Retirement Savings Accounts Act 1997;

- Life Insurance Act 1995;

- National Consumer Credit Protection Act 2009;

- Medical Indemnity (Prudential Supervision and Product Standards) Act 2003.

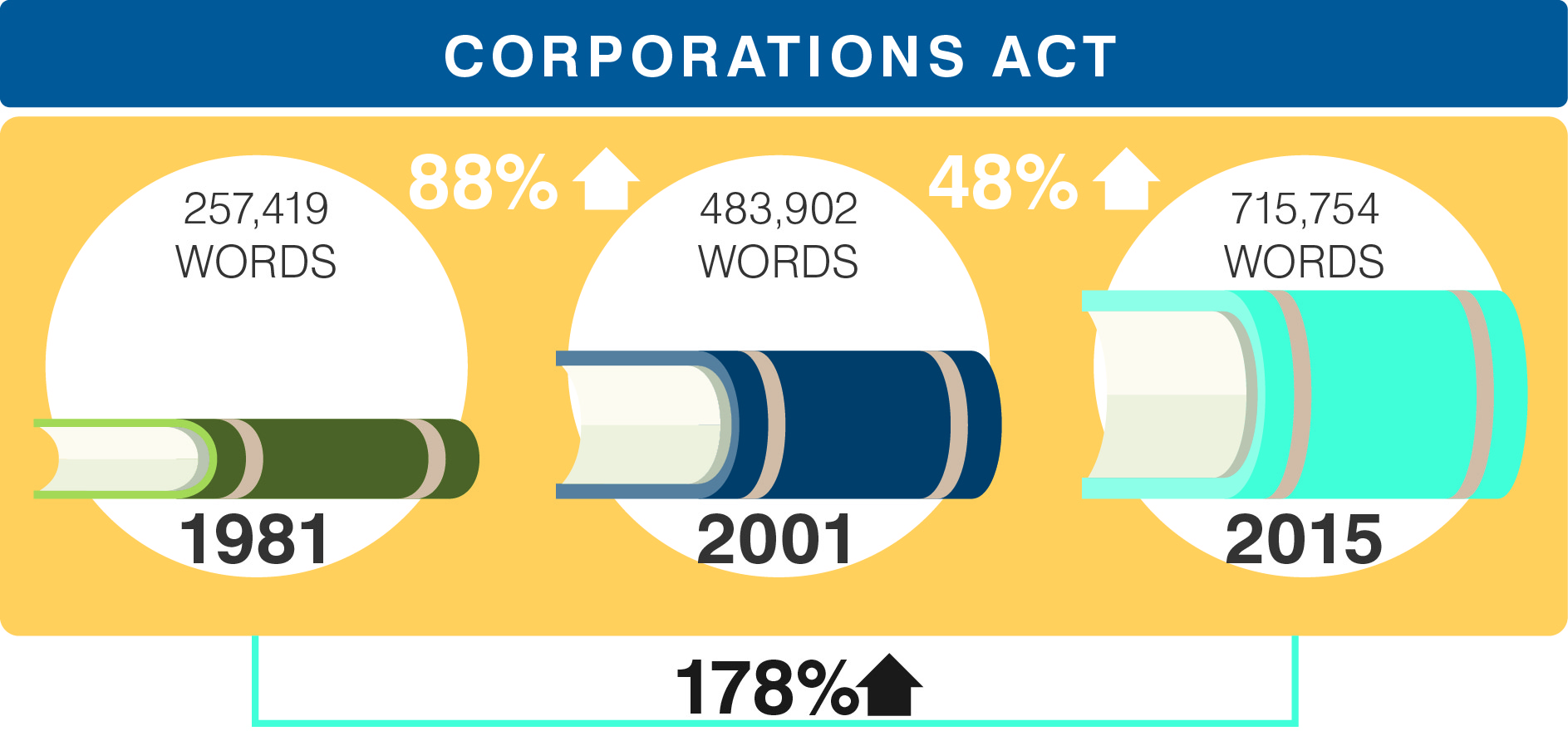

In particular, the Panel notes that the burden of administering the Corporations Act has increased significantly as a result of numerous amendments unmatched by any legislative reform:

- total length of the Act has increased by 178 per cent since 1981;

- the number of words in the Act has almost increased by 50 per cent from 2001 to 2015 (from 483,902 in 2001 to 715,754 in the most recent 2015 printed version);

- Chapter 7 of the Corporations Act, Financial Services and Markets is the longest Chapter of 380 pages and the regulations that provide more detail of the law for that chapter are an additional 304 pages.175

Figure 30 shows the increase in the length of the Corporations Act over 1981 to 2015.

Figure 30: Increase in the length of the Corporations Act

This sentiment is also shared by numerous members of the judiciary who note that 'every significant amendment to the corporations legislation … has added substantially to complexity' such that it is now 'inescapably complex'.176 Along with the noted increase in complexity has come a decrease in clarity, which requires additional guidance from the regulator.

While there is no measure available for the cost of this complexity, a number of consequences for ASIC have emerged:

- ASIC needs to provide guidance about how it intends to administer the law. As of July 2015 ASIC has published 253 Regulatory Guides and 209 Information Sheets.177

- ASIC assists industry in reducing the impact of complex legislation by exercising its power to grant relief to individuals or a class of persons from unintended consequences of the law or where the cost of compliance clearly outweighs regulatory benefit. This power has been used on more than 20,000 occasions since 2004, with an additional 10,000 applications submitted, but not successful.178

- Dependency on legal expertise in carrying out its functions — perhaps a factor explaining the relatively large proportion of employees with legal qualifications and experience (see Chapter 4).179

While legislative complexity is a burden and an impediment to ASIC, it also impacts those subject to it (that is, the regulated population). Impacts for the financial system include contributing to costs of compliance and a disincentive for international business being attracted into Australia. The FSI noted that Australia's international rankings for ease of doing business are lower than would otherwise be because of regulatory burden.180

The legislative complexity of the Corporations Act also poses a significant impediment to ASIC pursuing and securing mutual regulatory recognition with other international jurisdictions. ASIC's work in pursuing mutual recognition is and should remain a regulatory priority. To the extent that this legislative reform inertia remains an impediment to mutual recognition, it negatively impacts ASIC's ability to effectively pursue mutual recognition and to promote efficient capital flows to fund the real economy. It also forms a sizeable bedrock of regulatory cost for business in Australia.

Submissions to this Review and other recent inquiries note that 'reform fatigue' prevents industry from lobbying for a wholesale rewrite of the Corporations Act. Some elements of the Act, however, are recognised as being particularly problematic. Those include Chapters of the Act reliant on large numbers of regulations and class orders to give the provisions effect and operation, like Chapter 7 (financial products and services).181

Rationalising and streamlining this legislation could be reviewed as part of the Government's commitment to reducing regulatory red tape. This would both reduce the cost of compliance for regulated entities, and free up ASIC resources to focus on a wider range of regulatory tools, including education.

Collectively there is a clear twin policy imperative for pursuing legislative reform of the Corporations law — to both simplify and contemporise the law. The first is the significant and ongoing regulatory cost burden imposed on business in Australia. The second is the real impediment to mutual regulatory recognition with international jurisdictions with which Australian companies trade and from which all important incoming capital flows to Australia originate.

5.2. Funding limitations

There is a general and widespread belief that ASIC is underfunded. For example, 43 per cent of external stakeholders and 76 per cent of SELs and Commissioners believe that ASIC is not currently sufficiently resourced to do its job.182 Further, 89 per cent of SELs and Commissioners and 56 per cent of external stakeholders feel that ASIC needs more resources in the future industry funded model.1

83

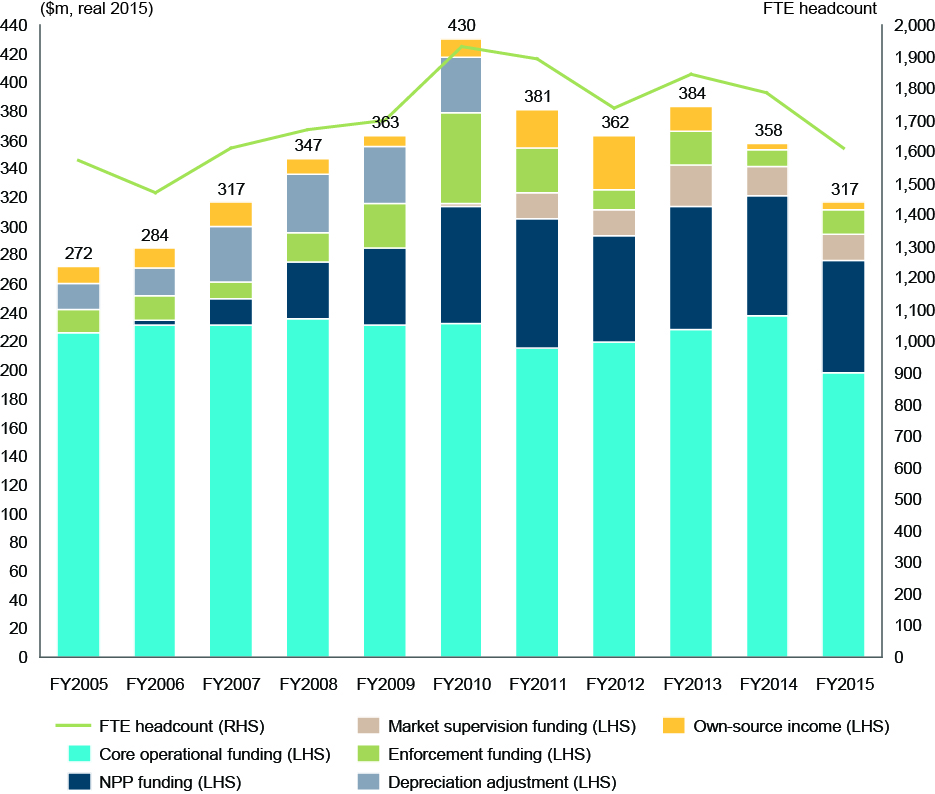

It is clear that ASIC has experienced difficulties in adjusting to a lower level of funding resulting from government savings measures imposed since a high point in funding in 2009-10 (see Figure 31 below). However, it does not necessarily follow that ASIC is 'under-funded', as this involves an assessment as to what is the right level of funding, given the scope and nature of its mandate and whether the funding is being used efficiently. Such an assessment is currently not achievable given a lack of available MIS to measure efficiency.

Over the period of 2005 to 2015 ASIC has been subject to an efficiency dividend of 1 per cent to 2.5 per cent annually, coupled with one-off cuts of 2 per cent (from 2007-08 to 2011-12) to 2.5 per cent (from 2012-13 to 2013-15). On a nominal basis, the cumulative impact of the efficiency dividend 2014-15 was around $25m of around $103m since 2004-05. The efficiency dividend has been applied to most agencies that receive direct funding from the Government, except for nine agencies with full or partial exemption.184 ASIC was also subject to an additional 10 per cent budget cut in 2015, which was applied to core and NPP funding (excluding capex and market supervision) on top of an efficiency dividend of 5 per cent (2.5 per cent annual and 2.5 per cent one-off).

Since 2004-05, ASIC's core operational funding has decreased around 12 per cent. However, there has also been considerable expansion in ASIC's mandate, which has been funded through approximately 60 new expense measures (New Policy Proposal — NPP funding) many of which are ongoing. This is a substantial number of NPPs for a government agency over this period of time. NPP funding for ASIC currently comprises around 19 per cent of total funding. In sum, ASIC's real funding has increased from $260m to $312m since 2004-05 (excludes own-source income).

NPP funding is managed separately for four years, or until funding is stable, and is then considered a part of 'core' funding (unless specifically allocated to a temporary activity). Of a total of $856.5m NPP funding, 68 per cent of this is ongoing, meaning that it has been, or can be, rolled into the base. The GFC Funding and Carbon Licensing NPPs are the only NPP themes to have been completely terminated since 2005 (in 2012 and 2015 respectively). The high proportion of ongoing NPP funding allows ASIC some flexibility after the initial four year period is completed.

The Panel thus concludes that ASIC's funding situation is not dissimilar to other agencies and regulators, who have also been subject to efficiency dividends and can apply for NPP funding. In real terms, ASIC's funding has increased with the expansion of its mandate. The Panel supports the FSI recommendation to move to a three year funding model to increase stability and certainty, and to facilitate longer term strategic planning and resourcing decision making. This is also consistent with ASIC's proposal in its Eight Point Plan. However, this should be made contingent on ASIC's development of MIS to allow future Government and industry assessment of ASIC's funding adequacy and operational efficiency and effectiveness. This will ensure the appropriate checks and balances on resource use, whilst still enabling ASIC to have operational control of its budget and provide greater incentives for ASIC to ensure value for money, whilst still giving ASIC greater flexibility and discretion in the use of its resources.

Figure 31: ASIC funding profile (real) FY2005 to FY2015185

5.3. Regulator cooperation

Cooperation between regulators can deliver enhanced regulatory outcomes, through encouraging information exchange, sharing best practice knowledge and reducing the regulatory burden on members of the regulated population.

The Panel believes that ASIC is currently constrained by a lack of sufficient attention by the CFR in driving coordination between domestic regulators. The CFR's objective is to provide a high-level forum for cooperation and collaboration among its members to improve the efficiency and effectiveness of financial regulation. It has achieved this objective in providing a flexible and low-cost approach to coordination, and a forum for dialogue between members.186

However, submissions made to the FSI indicated some concern about the CFR's membership, transparency and accountability, and called for its role to be strengthened.187 As such, the Inquiry considered three options including formalising its role within statute, increasing membership and increasing reporting. However, no changes were recommended, due to concerns about potentially overlapping responsibilities.

The Panel sees three key areas where enhanced collective leadership from the CFR could lead to improvements in regulatory outcomes for ASIC. These suggestions do not require any change to the scope, membership or reporting requirements of the CFR:

- Leading efforts to promote open government data to facilitate information sharing across domestic regulators (as discussed in Chapter 4) and data access for academics and industry. This should include discussing identified legislative limitations (for example, on accessing evidential material obtained by the Australia Federal Police under its search warrant powers) with the Government for further consideration.

- Ensuring increased coordination between domestic regulators to reduce the regulatory burden on members of the regulated population caused through overlapping areas of responsibility such as disclosure, lending and culture.

- Developing a forward work program to identify common long term strategic goals and a mutually agreed plan to deliver upon them.

Additionally, further extending data collaboration with peer conduct regulators overseas would both facilitate more efficient capital flows and ensure more effective and timely responses to global threats to the stability of financial markets (such as cyber security).

Consistent with the Panel's Terms of Reference, the Panel has provided these observations without specific recommendations. However, without action, they act as an impediment to ASIC effectively performing its role today and into the future. Importantly, lack of action will act as a constraint to the efficient flow of capital investment into Australia to underpin a higher level of economic growth and prosperity.

174 PwC 2015, ASIC Capability Review: Evidence Report — Volume 2, Sydney, page 1.

175 hia, H X and Ramsay, I 2015, 'Section 1322 as a Response to the Complexity of the Corporations Act 2001 (Cth)', Company and Securities Law Journal, Thomson Reuters, vol. 33, no. 6, page 391

176 The quotes relate to Austin J of the Supreme Court of New South Wales and High Court Justice Michael Kirby, respectively, ibid, page 391.

177 ASIC 2015, ACCC decision making processes and committees, Canberra. Viewed 30 November 2015 — < http://asic.gov.au/regulatory-resources/>.

178 Chia, H X and Ramsay, I 2015, 'Section 1322 as a Response to the Complexity of the Corporations Act 2001 (Cth)', Company and Securities Law Journal, Thomson Reuters, vol. 33, no. 6

, page 397.

179 bid, page 392.

180 Commonwealth of Australia 2014, Financial System Inquiry: Final Report, Canberra, page 260.

181 hia, H X and Ramsay, I 2015, 'Section 1322 as a Response to the Complexity of the Corporations Act 2001 (Cth)', Company and Securities Law Journal, Thomson Reuters, vol. 33, no. 6, pages 397, 398 and 403.

See, for example the Law Council of Australia's public submission to the Senate Economic References Committee Inquiry into the Performance of ASIC (Law Council of Australia 2013, Submission to the Senate Economic References Committee Inquiry into the Performance of the Australian Securities and Investments Commission).

182 Susan Bell Research 2015, ASIC Capability Review: ASIC leadership and stakeholder comparison survey, in Appendix E of Evidence Report — Volume 3, page 72.

In response to the statement 'ASIC is sufficiently resourced to do its job' — External organisational stakeholders: 15 per cent agree, 21 per cent midpoint, 43 per cent disagree, 20 per cent don't know; SELs and Commissioners: 11 per cent agree, 13 per cent midpoint, 76 per cent disagree and 0 per cent don't know.

183 Susan Bell Research 2015, ASIC Capability Review: ASIC leadership and stakeholder comparison survey, in Appendix E of Evidence Report — Volume 3, page 83.

In response to the statement 'The Government currently funds ASIC. If in the future industry funded ASIC' — External organisation stakeholders: 56 per cent believe 'ASIC needs more resources', 4 per cent believe 'ASIC needs fewer resources', 29 per cent believe 'ASIC's resources should remain about the same', 11 per cent 'I don't know'; SELs and Commissioners: 89 per cent believe 'ASIC needs more resources', 0 per cent believe 'ASIC needs fewer resources', 11 per cent believe 'ASIC's resources should remain about the same', 0 per cent 'I don't know'.

184 Horne, N 2012, 'The Commonwealth Efficiency Dividend: an overview', pages 8 to 9.

Three agencies have a full exemption, including the ABC, SBS and Safe Work Australia. Six agencies have a partial exemption, including the CSIRO, AIMS, Australian Council for the Arts, the Australian Customs and Border Protection Service, the Australian Nuclear Science and Technology Organisation, and the Department of Defence.

185 ASIC internal data.

186 Commonwealth of Australia 2014, Financial System Inquiry: Interim Report, Canberra, pages 3-117 to 3-119.

187 Commonwealth of Australia 2014, Financial System Inquiry: Interim Report, Canberra, pages 3-118 to 3-120.